How Much is Adequate? In Search of Equitable Missionary Compensation

by Bob Waldron

Mission leaders need hard data to help them exercise good stewardship of both the financial and human resources entrusted to them. This study of the compensation practices helps them do just that.

The chair of a local church mission committee asked, “How much should we pay our missionaries? Do you have any data that might help us?” These questions are being raised by an increasing number of congregations who are providing direct financial support for the missionaries they select and send, independent of a mission agency. This trend is problematic because local churches often have no set policies or standard practices regarding the important financial issues necessary for determining a reasonable compensation package for their missionaries.

Mission agencies are also wondering how effectively they are providing for their missionaries because, due to limited communication and collaboration, they often silo their expertise and unwittingly cloak their compensation practices in secrecy, not knowing how they compare with other agencies.

Leaders in both of these groups need hard data to help them exercise good stewardship of both the financial and human resources entrusted to them. That is why Missions Consulting International was asked to conduct a study of the compensation practices of respected evangelical mission agencies.

Facets of the Research

Our research touched on several major issues regarding missionary support levels:

• What should be the base salary for a missionary and how is that determined?

• What part does experience, education, age, and size of family play in determining missionary salary?

• Does the cost of living variable for different countries factor into the missionary support level?

• In addition to salary, what additional funds or benefits are commonly provided for missionaries?

Research Steps

We prepared an interview format and conducted telephone interviews with personnel in executive and managerial positions from five evangelical mission entities which have years of experience in missionary compensation. These ranged in size of their career missionary force from fewer than five hundred to more than four thousand. Agencies included the Assemblies of God, Christian and Missionary Alliance, Presbyterian Church USA, Southern Baptist International Mission Board, and The Evangelical Alliance Mission (TEAM). At their request, we are keeping their responses anonymous, referring to them in random order as Agencies A-E.

We verified the accuracy of the research by sending typed copies of the notes to the persons interviewed for editing and, if needed, for additional explanations. We then assessed the data from the telephone interviews and correspondence, prepared a draft of the report, and sent it to each of the entities for final editing or input.

Elements of Equitable Missionary Compensation

Jerry Burgess, who serves in the Professional Services Group of Missio Nexus as a missionary compensation consultant, stated that there are three considerations in determining missionary compensation: (1) we could hire missionaries like we would hire a coach, a CEO, or a corporate lawyer by asking what the market dictates—the more capable the individual, the more we would pay; (2) missionaries could realize that this is a high calling and that they must be willing to make a financial sacrifice towards its accomplishment; and (3) the church could exercise stringent stewardship on behalf of the donors (including both the wealthy members and the poor widows) whose offerings are used to support the missionaries. Burgess states that what is needed is a balanced approach that takes into consideration all three components.

Missionaries are not entitled to extravagant salaries, but agencies and churches that support them should ensure that their missionary servants are not being punished for choosing to serve the Lord overseas. This entails supplying an equitable salary, providing adequate housing and utilities, honoring their years of field experience, keeping abreast of the cost of living variables from country to country, providing educational opportunities for their school-aged children that are comparable, whenever possible, to what they would receive in the U.S., and offering a benefits package that includes insurance and retirement. These elements are discussed below.

Base salary. We asked the agencies how they determined the level of support needed by their missionaries worldwide. Three of the five agencies did not consider education, age, or size of the family in setting the base salary. Agency A seems to have one of the most objective standards for determining the base salary of their missionaries, linking it to the average annual teacher’s salary as reported by the American Federation of Teachers and multiplying that amount by seventy-five percent for a missionary couple with children. In 2012, the average teacher earned $52,289 x 0.75 = $39,217. Couples without children receive eighty percent of this, or $31,374 as a base salary, and singles get sixty percent.

Agency B determines their base salary on the historical salary they have been providing to their missionaries, which, at some time in the past, was roughly equivalent to what a mid-sized U.S. congregation would pay their preacher. Single missionaries receive sixty percent of this amount.

Agency C determines the base salary by the national trend and the economy. It is the only entity which reported that new missionary couples can negotiate the amount of their base salary, which is set at a maximum of $24,900. In addition to base salary, and exclusive of longevity allowance, missionaries under this agency receive monthly service increments based on their years of service, increments which can vary from missionary to missionary. A family that has been on the field for ten years could receive an annual increment of approximately $3,000 per year, increasing their base salary to a maximum of $27,900.

Agency D provides the highest base salary, but reduces the compensation package in other areas. They determine their base salary on the historical amount once provided to their missionaries, plus annual percentage increases to that amount over the intervening years. Their base salary for a career missionary couple sharing one position is $22,440 for each of the two spouses, or $44,880 for the couple. Single missionaries receive sixty-six percent of this amount. If the missionary couple fills two positions, the base salary increases to $53,856.

Agency E also has an objective standard for determining the missionary’s base salary by taking into account the salary of a local school teacher with a Masters degree and ten years of experience and the average salary of a pastor of a congregation of one hundred to three hundred members. After using these as guidelines, they add the current U.S. Cost of Living Allowance to form the base salary.

Housing Allowance and Utilities. All of the agencies cover one hundred percent of the housing costs. Several have agency-owned housing or stipulate that housing must be approved by the agency to qualify for reimbursement. The highest amount provided is $2,800 monthly. None of the agencies allow their missionaries to own their homes.

Three of the agencies pay one hundred percent of the cost for utilities, but Agencies A and E include those costs under the caps they have set for housing. Agency B provides a portion of the cost for utilities, if those costs exceed those of comparable utilities in the U.S. Agency D holds that utilities are the personal expense of the missionary.

Longevity Allowance. All of the agencies provide a longevity allowance to express appreciation to their long-term missionaries and to help avoid the attrition of seasoned personnel. This allowance begins at the start of the second or third five-year term.

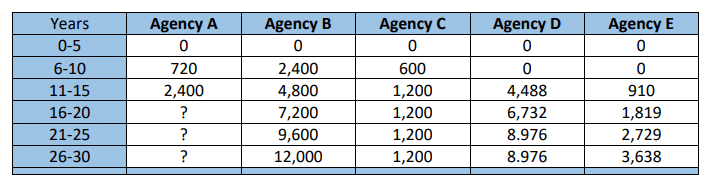

Agency A, which submitted data only for the first fifteen years of service, grants $720 annually for the second term and $2,400 annually during the third term. Agency B calculates the longevity allowance at $200 monthly for each completed five-year term. Agency C gives $600 per year during the second five-year period and caps the allowance at $1,200 annually for each following term. Agency D begins their monthly allowance at the start of the tenth year, providing ten percent of the base salary for the third term, increasing to fifteen percent for the fourth term, and twenty percent for each succeeding term. Agency E provides $910 annually per couple for those in their third term of service, with increases for each succeeding period up to $3,638 for couples who complete more than twenty-five years on the field.

Figure 1: Annual Longevity Allowance by Agency

Cost of Living Allowance (COLA). The purpose of the COLA is to afford the same buying power for all missionaries whether they live in expensive cities like Moscow or less expensive places like La Paz. To accomplish this objective, the agencies determine the amount needed for a livable salary in the United States and use that as a baseline, adjusting it with a COLA to cover the various costs of living in other parts of the world.

Agency E was the only group that subtracts from the base salary for those living in less expensive countries than the U.S., in some cases reducing the base salary by more than $10,000 annually.

All of the interviewed agencies report that they use the services of Mercer (www.mercer.com), a global consulting group, to provide the COLA rates. If individual direct-support churches cannot afford Mercer’s services for the COLA, they can use Internet resources, applying the recommended amounts only to the cost of goods and services, which include everything except reserves, housing, and taxes. Mercer does the math and provides a simple dollar figure as the COLA for the missionary’s salary level.

On-field Education for Missionary Children. All five of the agencies we interviewed provide one hundred percent of the on-field schooling costs for missionary children, but adds the cost to the missionary’s taxable income.

Schooling options can range from home schooling to private schools to missionary boarding schools. For Agency B, the amount varies from kindergarten through high school with the maximum of $4,000 annually per student in high school for home schooling and up to $9,000 per student for those attending national or international schools. The agency pays the majority of the Social Security tax on this benefit.

Agency C requires the child to attend the agency’s approved school in their area or be appropriately home schooled. Agency E pays the full cost for school expenses as taxable income to the missionary, but one hundred percent of the resulting additional Social Security and Medicare tax liability is paid by the mission as additional taxable income to the worker.

Insurance. To help alleviate the stress that accompanies disasters, emergencies, and health issues, all five agencies provide health and evacuation insurance, prescription drugs, and life insurance.

Agency A also allows missionaries to raise up to an additional $100 monthly in salary per spouse for a Health Savings Account. Four of the agencies also include a dental plan. Disability insurance is provided by all except Agency A. Agency C has no established plan to cover disabilities, but decides on a case-by-case examination. Three of the agencies also provide personal property insurance against fire, flood, or theft.

Retirement/Pension. All of the agencies provide 403(b) plans for their missionaries. Agency A has discontinued its pension plan for new missionaries, and requires couples to raise $160 in additional taxable support, which the agency then pays into their plan and will also match the missionary’s personal contribution up to another $60 per month. Agency B contributes an amount equal to five percent of the missionary’s base salary into a 403(b), which comes to $1,290 per year, and will match up to another three percent. A one-time retirement grant, based on years of service, is also provided to assist missionaries in reestablishing themselves during retirement. After twenty-five years of service, for example, a couple would receive $16,800. Agency E contributes about $1,000 per year per couple to their 403(b) account, an amount that varies from field to field. Agency D offers a 403(b) plan as an option for their missionaries, but has a pension plan into which the agency contributes $6,418 per couple, representing a retirement contribution of 14.3 percent of the base salary. These are reasonable amounts considering that missionaries must rent their homes and cannot build equity.

Figure 2: Percentage of Annual Base Salary

Paid to Retirement by Agency

Annual University Allowance for MKs. The size of the missionary’s salary generally makes it difficult for them to fund their children’s university education. This is compounded by the fact that foreign governments often do not allow spouses to work outside the home.

Four of the five agencies provide some help toward the cost of the MK’s university education as additional taxable income. Agency A provides $7,260 per year for up to four years over a five-year period for each MK attending a university or college in the U.S. Agency B provides a maximum of $5,000 a year per MK for up to four years for undergraduate schooling at a university. The family must have been on the field for at least three years and submit a request to the agency. Agency C does not cover any expenses for the university education of their MKs. Agency D contributes $600 a year per MK toward a college savings plan for every year they are on the field, up to age 22. A child born on the field and leaving for university at 18 years of age would have $10,800 to help with college expenses.

Agency E, while not providing any scholarships, reports that compensation rates take into account the number of children in the home. “In the home” includes two fiscal years after the year they graduate from high school, even if the children are away at university. This does not benefit families with only one or two children, since no increase in base salary is provided for them. Missionary couples with more than two children, however, receive a stipend of $3,720 annually, a total of $7,440 per child if they leave for university immediately after their high school graduation.

Taxes. Agencies A and D provide no assistance with Social Security taxes, seeing these as the sole responsibility of their self-employed missionaries (if they are classified as clergy). Agency B also looks upon their missionaries as self-employed and liable for one hundred percent of their Social Security taxes, but factors into the base salary, the COLA, and the Longevity Allowance a grant to cover one-half the cost of Social Security taxes.

Agency C also considers their missionaries as responsible for paying their own Social Security taxes, but allows the missionary to raise an additional $3,480 of annual taxable income to offset this expense. Agency E provides a grant as additional taxable income to clergy workers to cover fifty percent of their Self-Employment Tax. The agency pays the employer portion of Social Security/Medicare for non-clergy workers.

Some nations levy either or both income and Social Security taxes on income derived from other nations. All five agencies cover one hundred percent of the foreign income tax and all but Agency C also provide one hundred percent of the foreign Social Security tax. Funding for these taxes is considered additional taxable income for the missionary.

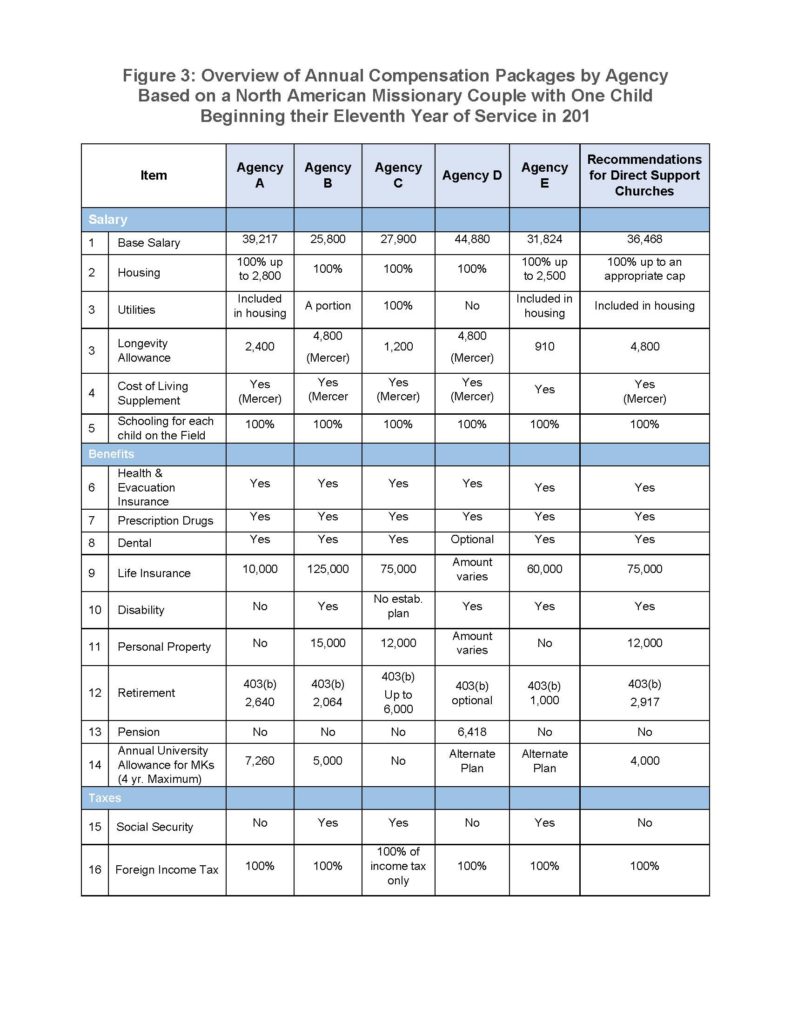

The purpose of the following chart is not to compare one agency with another, but to show the widespread agreement among mission agencies as to the kind of compensation missionaries need.

Figure 3: Overview of Annual Compensation Packages by Agency

Based on a North American Missionary Couple with One Child

Beginning their Eleventh Year of Service in 201

Application to the Mission Community

Interviewing representatives from the five evangelical groups provided a window through which we can observe a range of good mission practices, honed for decades by people committed to preaching Christ around the world.

The interviews highlighted the agencies’ commitment to good stewardship, both of the funds entrusted to them by faithful donors and the lives of the missionaries entrusted to their care. The results of this research can be useful both to direct-support churches and established mission agencies in determining an equitable compensation package for their missionaries.

Missionaries would be wise to adopt a policy of not spending all their income on the field, but to live as modestly as possible, identifying physically as closely as possible with the people they serve. The goal, after all, is not to leave a large financial footprint, but a large spiritual footprint.

Gratitude for the Participants

This study is indebted to Keith Kidwell, Linda Alexander, Jim Malone, Bill Ramirez, Gala Kizzar, Suzan Cantrell, Tom Jackson, and Kathy Dollinger for their amiability, thoughtfulness, and spirit of collegiality. They and the agencies they represent warrant profound gratitude from the entire mission community. A special thanks to Missions Resource Network, which commissioned the study.

….

Bob Waldron, DMin, planted churches and trained Christian leaders in Guatemala, taught missions for ten years, and was founding executive director for Missions Resource Network (1998-2010). After retiring, he launched Missions Consulting International (www.missionsconsulting.org) to serve the mission community.

EMQ, Vol. 50, No. 4, pp. 286-295. Copyright © 2014 Billy Graham Center. All rights reserved. Not to be reproduced or copied in any form without written permission from EMQ editors.